Bookkeeping for Construction Businesses : Keep Every Job on Track

RJ Partnering provides bookkeeping for construction businesses across Melbourne — helping builders and tradies manage site costs, payroll, BAS, and payroll tax efficiently. With the right systems in place, your projects stay organised, compliant, and profitable.

Why Bookkeeping for Construction Businesses Is Different

Construction is not a simple buy-and-sell operation. You work with staged payments, retentions, site labour, plant hire, variations and strict compliance rules. Good records are the only way to see which jobs are truly profitable.

- Multiple projects running at the same time

- Progress claims, deposits and retention money

- Subcontractor invoices and variations

- Complex payroll, allowances and site loadings

- BAS, GST and industry reporting obligations

For more detail on industry obligations, see the ATO’s guidance for the construction industry: ato.gov.au.

Job Costing Tips for Construction Bookkeeping

Job costing is the backbone of effective construction bookkeeping. Every cost and invoice should sit against a project or cost code, not just a generic expense account.

- Create cost codes for labour, subcontractors, materials, plant hire and overhead recovery.

- Assign each supplier bill and timesheet to the correct job.

- Compare budget vs actual regularly to catch margin issues early.

In Xero, features like tracking categories and Xero Projects make it easier to monitor job-level income and costs.

How to Manage Retentions and WIP in Construction Bookkeeping

Many construction contracts include deposits up front and retention amounts held until completion. These items need careful treatment to avoid overstating income.

- Record customer deposits as a liability until the related work is performed.

- Track retention money separately so it is not forgotten or double counted.

- Review work in progress (WIP) each month to match income with completed stages.

Accurate handling of WIP and retentions gives a true view of profit and supports lender, builder and accountant reviews.

Pay Your Team Correctly: Payroll, Super and Allowances

Construction payroll often includes travel, site allowances, overtime and different award rules. Mistakes lead to back-pay, penalties and frustration.

- Check current award rates and allowances via the Fair Work Ombudsman.

- Ensure Superannuation Guarantee is calculated on the correct earnings base: ATO super for employers.

- Use Single Touch Payroll (STP) correctly for every pay event.

- Maintain records for schemes like CoINVEST where relevant.

If payroll is taking too much time, consider our payroll services for Melbourne businesses.

Understand Payroll Tax for Victorian Construction Businesses

When your taxable wages exceed the Victorian payroll tax threshold, you may need to register with the State Revenue Office (SRO). This can happen quickly in construction where wages, superannuation and some contractor payments add up.

- Include gross wages, superannuation, bonuses and eligible contractor payments when assessing the threshold.

- If you exceed it, register with the SRO and lodge payroll tax returns as required.

- Use this simple view as a guide: (taxable wages − annual threshold) × payroll tax rate.

Thresholds and rates change. Always confirm current figures at sro.vic.gov.au/payroll-tax or speak with your advisor before lodging.

Get BAS, GST and Subcontractor Records Right

Progress claims, mixed supplies and subcontractors on different arrangements make GST more complex. Correct coding is essential for accurate BAS lodgements.

- Check ABN and GST status for each subcontractor.

- Apply GST correctly on materials, labour, plant hire and margin.

- Keep clear copies of invoices, contracts and variations.

If you are unsure, our BAS lodgement support can review your file before submission.

Build a Simple, Reliable Bookkeeping Rhythm

Many construction businesses struggle not because work is slow, but because records are behind. A simple weekly and monthly routine prevents problems.

- Upload receipts and invoices promptly from site.

- Reconcile bank accounts weekly.

- Review job profitability monthly.

- Schedule BAS, super and payroll dates in advance.

If your books are already behind, our emergency bookkeeping service can help you catch up quickly.

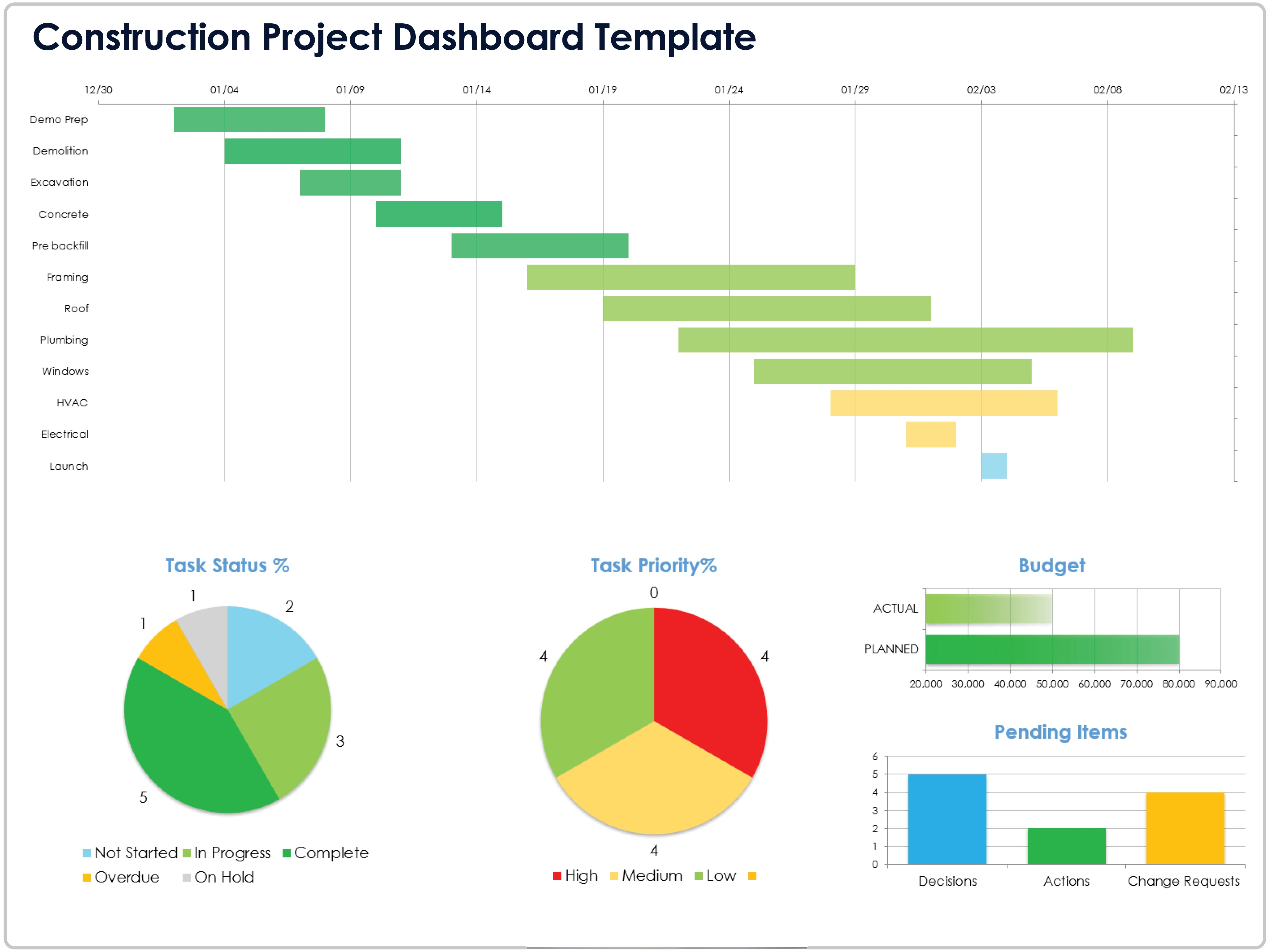

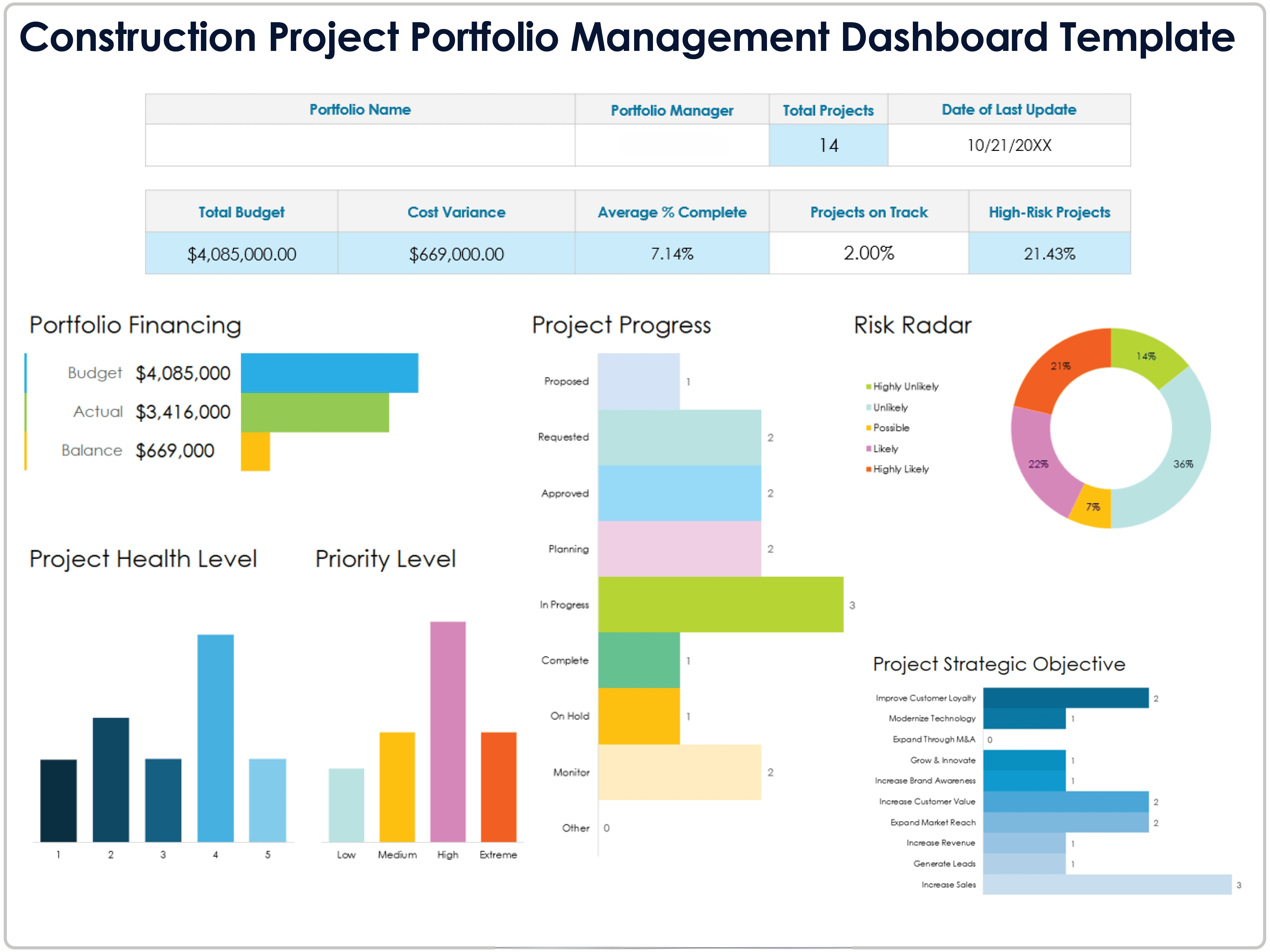

Use Dashboards to See Your Jobs Clearly

Dashboards turn your bookkeeping and job data into a clear picture of how projects are tracking. Instead of digging through spreadsheets, you can see deadlines, costs and risks on one screen. The examples below show how this can look for a construction business.

This project dashboard highlights a single job. A Gantt-style chart shows each stage from demolition to handover, with colour-coded progress. Supporting charts display task status, priority and budget comparison so supervisors can see delays and cost pressure early.

The portfolio dashboard looks across all projects. It summarises total budget vs actual, cost variance, projects on track and key risk indicators, giving owners a quick view of which jobs need attention before they affect cash flow.

The underlying information for these dashboards can come directly from your bookkeeping system. Many of the same metrics can be produced using Xero reports, Xero Projects and tracking categories. For more advanced visuals, data can be exported into tools such as Smartsheet or business intelligence dashboards while still relying on accurate books in the background.

The aim is simple: one reliable place to see which jobs are profitable, which are at risk, and how your construction business is performing overall.

How RJ Partnering Supports Construction Businesses

RJ Partnering works with builders, trades and subcontractors across Melbourne’s south-east. We understand job sites, progress claims and the pressure of deadlines. Our role is to keep your numbers accurate so you can focus on delivering quality work.

- Set up or clean up Xero, MYOB or QuickBooks for construction use.

- Design job costing structures and reporting that make sense.

- Manage payroll, super, STP and related obligations.

- Prepare BAS and support you during any ATO queries.

- Offer fixed-fee packages so you can budget with confidence.

Need Straightforward Bookkeeping for Your Construction Business?

If you want clearer numbers on each job, fewer surprises at BAS time, and a bookkeeping partner who understands construction, speak with RJ Partnering today.

Book a Free ConsultationBookkeeping for Construction Businesses — FAQs

Do I need to track each project separately?

Yes. Tracking income and expenses by project shows which jobs are profitable and supports more accurate quoting on future work.

How often should I review job profitability?

A monthly review is usually enough. Higher volume businesses may check more often for tighter control.

Can you help set up Xero for construction?

We can structure your chart of accounts, tracking categories, payroll and job costing in Xero or MYOB to suit your projects.

What happens if my books are behind?

We provide catch-up bookkeeping to bring records up to date and prepare accurate BAS and management reports.

Do you work with my tax accountant?

Yes. We work alongside your accountant to keep information clean and complete, saving time at year-end.