Working Capital: What It Is and Why It Matters for Small Businesses

Working capital is the money your business uses to run day to day. It keeps wages paid, suppliers happy and the ATO off your back. When it’s tight, everything feels hard. When it’s healthy, you can finally breathe and plan ahead.

1. What is working capital?

In simple terms, working capital is the money you have available to run the business between paying your bills and getting paid by customers.

On your balance sheet, it’s usually described as:

Working capital = Current assets – Current liabilities

For a typical small business, that includes things like:

- Current assets: bank accounts, undeposited cash, customer invoices (debtors), inventory and sometimes prepayments.

- Current liabilities: supplier invoices (creditors), credit cards, overdrafts, PAYG and GST owing, superannuation and short-term loans.

If your current assets are higher than your current liabilities, you have positive working capital and more breathing room. If it’s the other way around, you’re constantly trying to juggle payments and hoping customers pay on time.

A good bookkeeping system like Xero-based bookkeeping with RJ Partnering makes it much easier to see your working capital position in real time instead of guessing. For a formal definition widely used in finance, see: Investopedia – Working Capital Definition .

2. Why working capital matters for small businesses

Profit gets all the attention, but it’s working capital that quietly decides whether your business can actually pay its bills on time.

Healthy working capital helps you to:

- Pay wages, super and suppliers on time without relying on credit cards every month.

- Cover BAS and tax bills when they fall due, instead of scrambling for cash.

- Buy stock or materials ahead of busy periods.

- Handle slow months or late-paying customers without panic.

- Say “yes” to good opportunities like discounts for early payment or a new contract.

The ATO regularly reminds small businesses to plan their cash flow and understand their obligations, because many viable businesses fail simply from running out of cash, not from lack of sales or profit.

If you’ve read our earlier article on Why profit isn't cash flow, you’ll know that profit on paper doesn’t always mean money in the bank. Working capital is where that gap usually shows up.

The ATO regularly reminds small businesses to plan their cash flow and understand their obligations, because many viable businesses fail simply from running out of cash. See the official guidance here: Business.gov.au – Managing Cash Flow .

3. Working capital, profit and cash flow – how they connect

It helps to see how these three fit together:

- Profit = what’s left after income minus expenses over a period.

- Cash flow = the timing of money actually coming in and going out.

- Working capital = the pool of short-term funds that smooths out that timing.

You can be profitable, but if customers take 60+ days to pay while you pay suppliers in 14 days, your working capital will be under pressure and your cash flow will feel tight.

The good news is that working capital is something you can actively manage with better billing, tighter follow-up and smarter use of terms. That’s where the cash conversion cycle comes in.

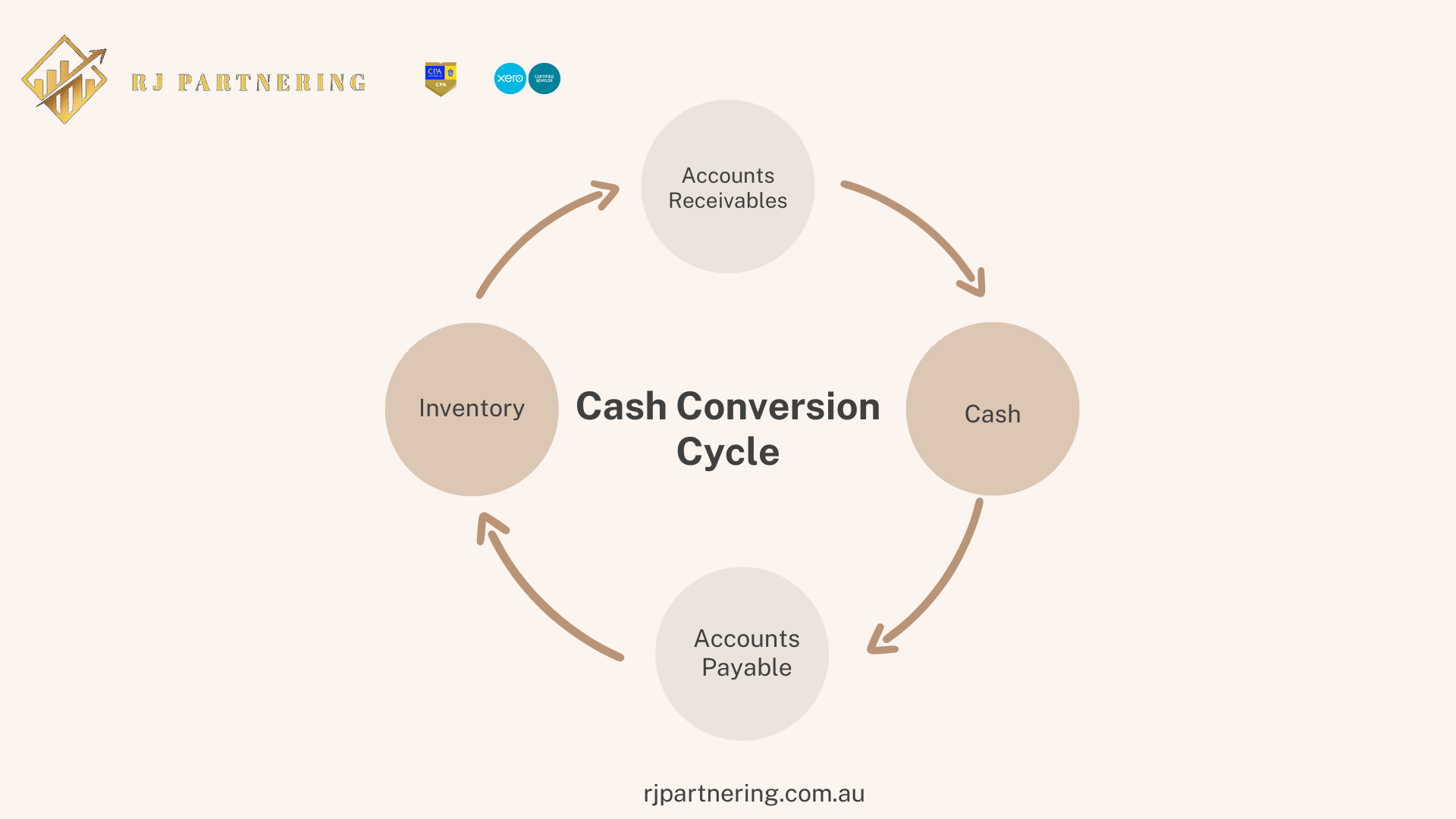

4. The cash conversion cycle: turning stock and invoices back into cash

The cash conversion cycle (CCC) is a way of measuring how long it takes for cash you spend on stock and costs to come back to you as cash received from customers.

Think of it as a loop:

- You pay for stock or materials.

- You sell goods or complete work (often on invoice terms).

- You wait for customers to pay the invoice.

- Cash lands back in your bank account.

The longer that loop takes, the more working capital you need to keep the business moving.

In finance terms, the cash conversion cycle is often broken into three parts:

- Days Inventory Outstanding (DIO): average days your stock sits before it’s sold.

- Days Sales Outstanding (DSO): average days customers take to pay invoices.

- Days Payables Outstanding (DPO): average days you take to pay suppliers.

A simple version of the formula many banks and finance providers use is:

Cash Conversion Cycle = DIO + DSO – DPO

You don’t need to become an analyst. The key idea is this: if you hold stock for fewer days, collect invoices faster, and make sensible use of supplier terms, your cash conversion cycle shortens and your working capital goes further.

Many accountants and banks analyse these three metrics when assessing liquidity and financing. CPA Australia also discusses short-term cash management here: CPA Australia – Business & Financial Resources .

5. A simple example for a small business

Imagine a small Melbourne wholesaler selling parts to tradies:

- On average, stock sits on the shelf for 45 days before being sold.

- Customers are on 30-day terms, but many pay closer to 40 days.

- The business pays suppliers roughly 25 days after invoice.

Their rough cash conversion cycle looks like this:

CCC = 45 days (DIO) + 40 days (DSO) – 25 days (DPO) = 60 days

That means from the time they pay a supplier to the time they see the cash back from the customer, they are out of pocket for about 60 days. The faster they can move stock and collect invoices (or the better they manage supplier terms), the lower that number becomes and the less working capital they need to fund that gap.

If you’re not sure where to start, even a rough calculation from your Xero reports can give you a feel for whether your business tends to be closer to 20, 40 or 80+ days.

6. Practical ways to improve working capital (and your cash conversion cycle)

6.1 Invoice faster and make it easy to pay

Many small businesses lose weeks of working capital simply by waiting too long to issue invoices.

- Invoice as soon as work is completed or milestones are reached.

- Use online invoicing with payment links (card, BPAY, bank transfer).

- Send gentle reminders before due dates, not weeks after.

- Be clear on terms (for example, 7 or 14 days instead of “end of month”).

6.2 Tighten up receivables (your DSO)

If customers regularly pay late, your working capital will always feel tight.

- Run an aged receivables report weekly and follow up overdue invoices.

- Ask for deposits or progress payments on larger jobs.

- Review credit terms for consistently late customers.

- Consider payment plans instead of letting large debts quietly grow.

6.3 Manage stock more deliberately (your DIO)

Too much stock ties up cash. Too little stock can stall sales. The sweet spot is different for every business.

- Identify slow-moving lines and reduce or clear them.

- Forecast based on real sales data, not just gut feel.

- For project-based work, link purchasing more closely to confirmed jobs.

If you’re in construction or trades, proper job-costing and construction bookkeeping can stop materials and labour costs from disappearing into one big “WIP” bucket.

6.4 Use supplier terms wisely (your DPO)

Paying suppliers on time is important, but you also don’t have to pay everything instantly if you have agreed terms.

- Know exactly what terms you have with each major supplier.

- Take early-payment discounts when the numbers make sense.

- Avoid paying very early unless cash is strong.

- Talk to key suppliers early if you need short-term flexibility.

6.5 Keep the ATO and super in the plan

BAS, PAYG and super are some of the biggest hits to working capital for Australian small businesses.

- Set aside money for GST, PAYG and super each week or month.

- Use a separate “tax holding” bank account so it doesn’t get spent.

- Forecast BAS and tax payments ahead of time, not just when the notice arrives.

For full guidance on PAYG, GST and superannuation obligations, refer to: ATO – Businesses and Organisations .

If you’ve recently registered for GST, our guide on how to register for GST in Australia explains what changes in your invoicing and bookkeeping once GST is in the mix.

7. Turning working capital into a strength, not a stress

Working capital doesn’t have to be a mystery. Once you understand the basic pieces – stock, debtors, creditors and the cash conversion cycle – it becomes much clearer why cash sometimes feels tight even when sales are strong.

With the right bookkeeping processes, regular reports and a bit of discipline, you can slowly shorten your cash conversion cycle and turn working capital into a quiet strength instead of a constant worry.

You don’t have to fix everything in one go. Even small improvements – a faster invoicing routine, one extra receivables follow-up each week, clearing out dead stock – can make a noticeable difference over the year.